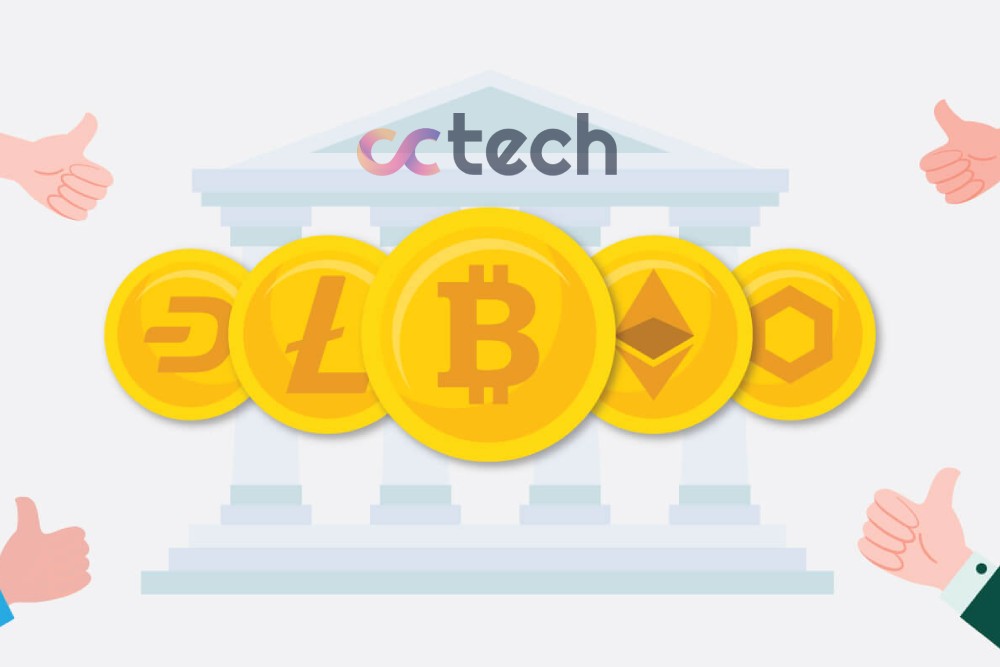

Digital assets were created to change the traditional economy. For example, bitcoin is used as an alternative payment method. Most cryptocurrency projects aim to make this world more convenient and secure. They offer low fees, anonymous transactions, no restrictions on making transfers. On the other hand, many developers are trying to benefit from market growth by creating coins and tokens with no purpose or utility. Understanding the essence of the project and determining the investment appeal will help to assess the liquidity of the cryptocurrency. It is enough to spend some time to understand which digital units are worth investing in, and which altcoins are more like fraudulent projects.

The concept of liquidity

In the cryptocurrency market, it is important to consider how easily and quickly a digital asset can be converted into cash without affecting its market price. The higher the liquidity, the less volatile and more stable the cryptocurrency. Counterparties always want to enter into a transaction with such assets. This means that if a user sells bitcoins or altcoins, there is always someone willing to buy cryptocurrencies. And if someone wants to buy coins and tokens, there is a market participant who intends to sell them.

There are 3 levels of liquidity in the cryptocurrency market. The division occurs depending on the object in which capital is invested:

Exchange liquidity – when the platform has limit and market orders and desirable trading pairs for transactions.

Asset realizability – when a digital unit has buyers and sellers.

Market Liquidity – an indicator that shows how healthy the cryptocurrency market is.

These indicators should be considered in a trading or investment strategy. They allow you to sell an asset quickly and without a strong price change if necessary.

What affects the liquidity of cryptocurrency

The marketability of a particular asset depends on the following conditions:

Price. Trading volume (over the last 24 hours).

The number of all trades made in a certain period is the most important factor that many novice traders and investors focus on. But more experienced market participants understand that both the price of the asset and the turnover affect crypto liquidity. For example, bitcoin is one of the most traded assets with a daily transaction volume of $20.4 billion. Considering the coin’s price, BTC turnover in 24 hours can be up to 638,500 units. Cardano cryptocurrency shows a daily trading volume of ~1.2 billion ADA. At the same time, the coin is more liquid than the bitcoin. If we talk about the top 10 digital assets, most of them have the highest marketability rates.

Liquidity pools. It is important for a trader to sell assets quickly. Market participants who trade depend on the regularity and speed of execution of orders. That’s why the order book should be filled with buy and sell offers that are quickly realized. In another situation, the trader will not trade on the exchange and will subscribe to competitors’ platforms. Liquidity providers are responsible for the depth of the order book.

For example, JP Morgan (the world’s largest bank) is the market maker in the currency market. If users need to exchange U.S. dollars for euros, the company will provide a price quote (the current rate announced by the seller or buyer, at which traders will trade assets) as well as a liquidity offer. Without an intermediary, traders would have to wait until counterparties put their assets up for sale at the declared value. By then, the market price of the currency could change.

However, in the cryptocurrency environment, there are no organizations that serve as liquidity providers. This responsibility falls on the shoulders of ordinary users. DeFi projects solve this issue.

When customers put cash in the bank, that money becomes available for lending programs and other financial transactions. In exchange for the capital provided, investors receive interest.

When users invest their cryptocurrency funds in the DeFi pool, thanks to a smart contract, they take over the function of the bank and no longer need an intermediary. Common funds are locked into the protocol for a certain period of time, and other traders can use this capital to trade or receive loans.

The Liquidity Trap

This is an economic situation where everyone is saving money instead of investing or spending it. The liquidity trap occurs in times when the economy is down. People don’t want to spend money, so they just keep cash.

The cryptocurrency liquidity trap is related to the decreasing amount of digital assets in circulation. Supply can be limited by the following factors:

Coins and tokens are lost or are in wallets that cannot be used. For example, people can’t find their private keys.

Altcoins with unlimited issuance are burned to avoid inflation. For example, ETH and BNB.

Bitcoin and altcoins are locked in decentralized finance (DeFi). For example, to get wBTC, you have to take BTC out of the market.

Ways to calculate liquidity

Bitcoin and altcoin’s marketability metrics are directly related to exchanges. When calculating the liquidity of a cryptocurrency, one should take into account:

The number of currency pairs (markets)

The number of coins and tokens registered on the exchange.

Trading volumes in 24 hours. The higher the turnover on the platform, the better. But this is not always the case. For example, exchange “A” added 235 coins, which allowed traders to exchange 519 pairs. And the daily trading volume on the platform was $714 million. Marketplace “B” offered 30 top-rated coins that created 94 markets. The trading turnover was $511 million. Considering the number of currency pairs, the “B” exchange is more liquid, despite lower sales volumes.

Conclusion

One important feature of digital finance is that speculation has little impact on market development. Over time, the stable integration of coins and tokens into society becomes evident. This is reflected in the use scenarios of virtual money, the growing number of wallets and transactions, and the increasing liquidity of the cryptocurrency market. The volume of digital assets traded on major exchanges in 2021 was significantly higher than in 2017- 2018, when the highest BTC price point of $18,000 to $20,000 was discussed all over the news. Cryptocurrency liquidity matters because bitcoin and altcoins are marketable commodities. For the environment to develop, users should have no problem exchanging digital assets. In addition, the liquidity of a coin (token) can also affect the user experience.