As cryptocurrencies grow in popularity, so does the complexity of digital networks. In 2022, it is not profitable to mine assets solo. Therefore, miners join together in pools. Such services distribute the task among participants and pay a reward based on the spent capacity. Pools take a fee for this – up to 20% of earnings. Not all participants agree with this. Owners of large capacities are looking for ways to create their own mining pool. To do so, you need to buy equipment, create software, and think through an advertising campaign. You’ll have to work in a highly competitive environment. Experience in blockchain is not necessary, but it will help overcome the pitfalls.

Specifics of a personal pool for mining

Digital currency mining is a highly competitive business. According to MiningPoolStats monitoring, there are more than 600 mining pools in the world in 2022. Many major platforms were founded in 2010-2013 by blockchain enthusiasts.

You don’t have to have a good understanding of the crypto market to launch a service. It is enough to buy powerful equipment. However, only enthusiastic crypto-entrepreneurs, who have studied the work of a mining pool from the inside, succeed in this field. The table contains statistics on group mining of the largest digital currencies as of June 2022.

The owner of a personal resource for mining cryptocurrencies:

Does not pay a commission to the organizers.

• Can customize the platform according to his tasks.

• Determines the cryptocurrency to be mined. Can switch between coins.

• Makes a profit even with small commissions. The amount of income increases with the popularity of the resource.

It takes a lot of effort to create a mining pool. In addition to writing code and assembling, investments in advertising and technology will be required. Also, to launch the platform you need to:

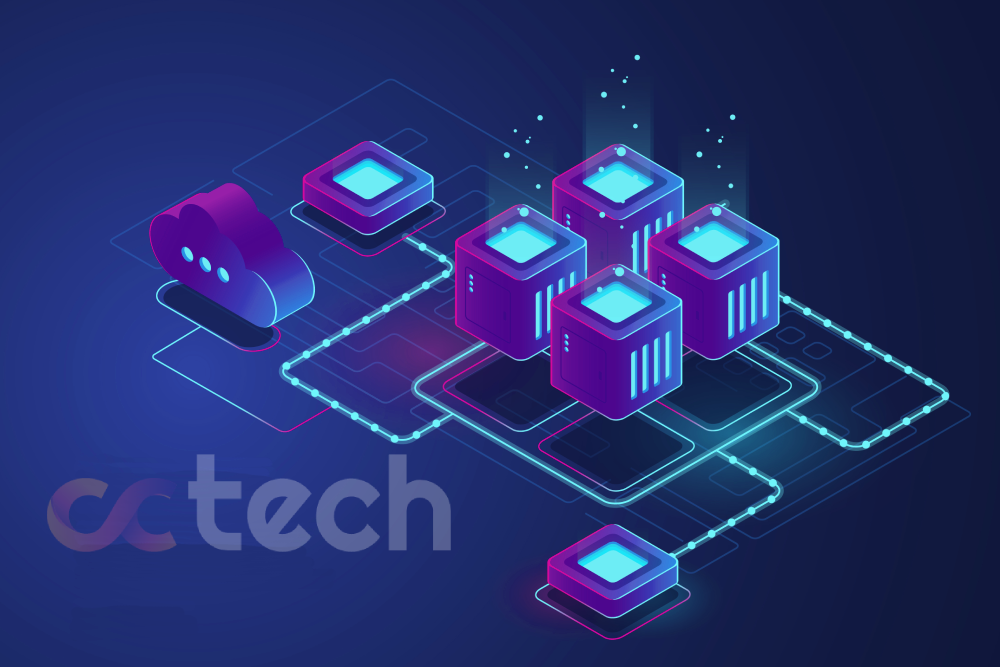

Rent servers. Ping to the client should not exceed 100 milliseconds. This requires quality communication channels and dedicated servers in different countries. Potential growth of the platform must be taken into account. The server must have a power reserve.

Provide fault-tolerance of the system. To do this, you need to sign a contract with a data center with high Uptime (server uptime). It is good if the company has a certificate not lower than Tier III. Hosting must guarantee the constant operation of equipment. Therefore, the contract must include maintenance.

Hire staff. To keep the service running, you need to develop the site, engage in promotion, edit scripts and communicate with customers. Even at the initial stage there may be a need for employees. Their work should be paid regardless of whether the project is profitable. Good programmers, internet marketers, administrators with knowledge of the crypto market can be found on freelance exchanges, forums and Telegram chat rooms.

Choose a digital currency for mining. Platforms offering to mine a single coin are losing popularity. The situation in the crypto market is changing rapidly. Users want to be able to switch between coins.

How to create and set up your own mining pool

To run a service for mining cryptocurrencies, you need to install the software. You can get it in the following ways:

Write a script. To do this, you need to understand how a mining pool is set up, know the principles of the blockchain and know the programming languages. It is also necessary to study the specification of the selected coins.

Download the program on GitHub and customize it. You will have to work out the graphical interface of the site yourself, optimize and run the platform.

Order an individual project. Requires the help of a programmer with an understanding of blockchain principles.

To write the script, you need to work out the code. Mistakes are fraught with unstable operation and loss of customer funds. Therefore, developing new software requires a lot of time and money.

The cost of creating a pool for mining

A platform for mining digital currencies must be available around the clock. The owner of the pool needs to foresee power and internet outages. Therefore, it will not be possible to create a service for group mining on a home PC. The following costs must be taken into account:

Software development. The price depends on the complexity of the scripts for mining. For example, creating an etherium mining platform from scratch will cost an average of 60 ETH. The price will be several times higher if you need to provide mining of several cryptocurrencies. Usually, pools offer to mine 2-4 coins. Large platforms can mine 10-15 cryptocurrencies. The software should analyze the complexity of the network and select the asset.

Server assembly. In 2022, the price of work for one coin is $100-$200.

Server rental. In unlimited plans, providers offer narrow bandwidth. The minimum package price is $45 per month. Bandwidth is 20-100 Mbps. In a mining pool, you need 30-50 MB/s per user. So you have to buy a package with limited traffic (minimum 1000 rubles per month) and rent a dedicated server (2 thousand rubles or more). If the service becomes popular, for uninterrupted operation it will be necessary to rent additional devices. For example, Flypool places 3 servers: in Asia, Europe and USA.

Advertising. To attract users, there should be a marketing campaign. The minimum price is $100 per month.

Salaries of staff. Serious service needs round-the-clock monitoring for rapid troubleshooting.

Conclusion

To create a pool for mining, you need to invest at least 4 million rubles in equipment. You will also need to pay for the programmer and order a competent advertising campaign. Experience in writing code and blockchain will be an advantage.

Profitability of a personal pool depends on the approach to implementing a business plan. It does not make sense to create a service for mining top cryptocurrencies because of the great competition. It is better to focus on coins with less network complexity. Monero and Zcash mining are popular in 2022

Entrepreneurs with experience are mining new coins that have recently passed the ICO. However, this requires technical and fundamental analysis of the asset. There is a high risk that new cryptocurrencies will quickly disappear from exchange listings.