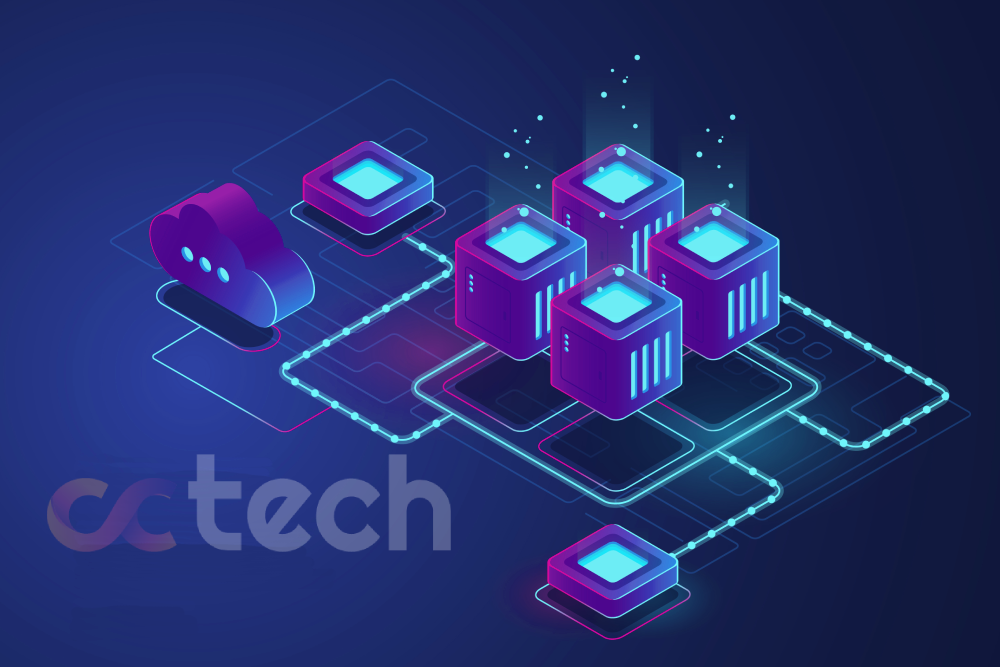

In blockchain networks, transaction fees serve two important functions. They reward the miners or validators who help confirm transactions and protect the network from spam attacks.

Depending on the activity on the network, transaction fees can be either small or high. Market conditions also affect its size. High fees can discourage the use of blockchain, while too low fees can potentially cause security problems.

Why do we need transaction fees?

Transaction fees have been an integral part of most blockchain systems since their inception. You have probably already encountered various commissions when sending, depositing, or withdrawing cryptocurrencies.

Most cryptocurrencies use transaction fees for two reasons. First, they reduce the amount of spam on the network, making large-scale spam attacks costly to implement. Second, transaction fees provide an incentive for users to help verify and validate transactions. It is a kind of reward for helping the network work.

Transaction fees are quite low in most blockchains, but they can increase significantly depending on the traffic on the network. For you as a user, this means that the amount you choose to pay determines the priority of your transaction when it is added to the next blockchain. The higher the fee, the faster the confirmation process will go.

Bitcoin transaction fees

As the world’s first blockchain network, bitcoin set the standard for transaction fees that many cryptocurrencies use today. Satoshi Nakamoto realized that transaction fees could protect the network from large-scale spam attacks and encourage correct behavior.

Bitcoin miners receive a commission during the confirmation of a transaction for a new block. The pool of unconfirmed transactions is called the “memory pool” (or “mem pool”). Of course, miners will prioritize transactions with higher commissions that users have agreed to pay when sending their BTCs to another bitcoin wallet.

Consequently, attackers wishing to slow down the network must pay the commission associated with each transaction. If they set the fees too low, miners are likely to ignore their transactions. If they set them at a suitable level, however, they will incur high costs. In this way, transaction fees also work as a simple but effective filter against spam.

Transaction fees for Ethereum

The way transaction fees work for etherium is different from bitcoin. The amount of commission takes into account the amount of processing power required to process a transaction, known as gas. Gas also has a variable price, measured in ether (ETH), the network’s native token.

The amount of gas required for a particular transaction may remain the same, but the price may rise or fall depending on network traffic. If you pay a higher gas price, the miners are likely to process your transaction first.

Transaction fees in Binance Chain

Binance Chain is a blockchain network that allows users to transact and trade BNB and other BEP-2 tokens as well as create and distribute their own tokens. Binance Chain uses a consensus mechanism called Delegated Proof of Stake. Therefore, instead of miners, we have validators.

Binance Chain also underpins Binance DEX (a decentralized exchange), where users can trade crypto-assets directly from their wallets. Transaction fees on Binance Chain and DEX are paid in BNB. Please note: Binance Chain and Binance Smart Chain are two different blockchains.

Transaction fees are an integral part of the crypto-economy of blockchain networks. They serve the function of rewarding users who keep the network running, and are also used as protection against malicious users and spam.

However, the growth of traffic on some networks has led to a significant increase in fees. The decentralized nature of most blockchains makes them difficult to scale. At the same time, some networks with high scalability and bandwidth often have to sacrifice either security or decentralization.

Nevertheless, various researchers and developers are actively pursuing improvements that will hopefully lead to the proliferation of cryptocurrencies in the developing world.