Today Chainlink is one of the most popular cryptocurrency projects. This decentralized oracle service provides external data to Ethereum smart contracts, that is, it connects blockchains to the real world.

Chainlink can be thought of as a collection of pundits engaged in a search for truth. But why should this network be more trustworthy than others? Let’s look into it.

Introduction

Smart contracts automate agreements on the blockchain: they evaluate information and execute agreements if certain conditions are met. But this is where the problem comes in.

Blockchains themselves lack an efficient mechanism for accessing external data. The difficulty of combining off-chain data with on-chain data is one of the main problems with smart contracts.

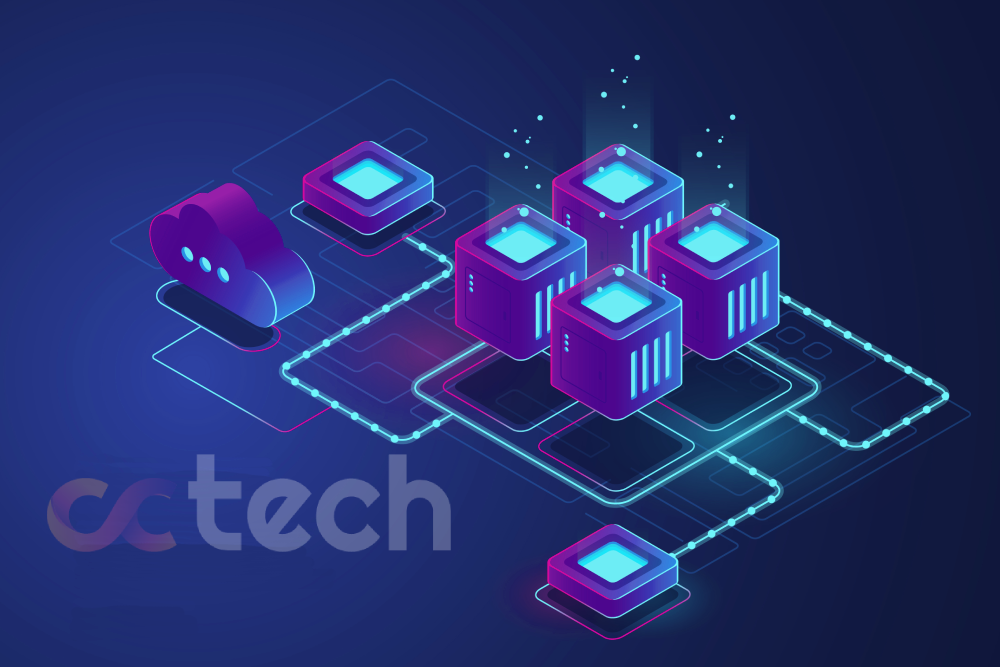

Chainlink, a decentralized oracle system, is used to solve exactly this problem. In short, an oracle is a program that translates external data into a language that the smart contracts understand (and vice versa).

What is Chainlink?

Chainlink is a blockchain-based decentralized oracle network that allows smart contracts to connect to external data sources, including APIs, back-end systems, and other types of external data channels. The LINK used to pay for the operation of this service is the ERC-20 token.

So what makes the Chainlink system decentralized? First, let’s understand what a centralized oracle is. It’s not hard to guess that it’s a single provider of external information for a smart contract. That is, it is a single source, which can lead to serious problems. What if this oracle provides false or incorrect data? Then all the systems that depend on it will fail. This aspect is called the “oracle problem”, and that is what Chainlink is designed to deal with.

How does Chainlink work?

Chainlink uses a network of nodes to ensure the reliability and validity of the data sent to smart contracts.

For example, a smart contract needs data from the real world and sends a request. The Chainlink protocol registers this request and forwards it to its nodes to accept their bids.

An important advantage of Chainlink is that it can validate data from multiple sources. Thanks to its internal reputation system, Chainlink determines with high accuracy which sources are trustworthy and which are not. This greatly increases the accuracy of the results and protects smart contracts from all sorts of attacks.

But what does all this have to do with LINK? Smart contracts that request data pay for the services of node operators in LINK tokens. Prices are set by the operators according to market conditions.

The node operators also add tokens to the network stacking to ensure long-term cooperation with the project. Similar to the bitcoin crypto-economic model, Chainlink node operators are interested in operating with quality and ensuring the reliability of the network.

Chainlink and DeFi

As decentralized finance (DeFi) has grown in popularity, so has the demand for quality oracles. Most of these projects use smart contracts in one way or another, and they require external data to work properly.

Because of centralized oracles, DeFi platforms can become vulnerable to a variety of attacks, including flash-credit attacks that manipulate oracles. Such cases have happened before and will happen again in the future if the use of centralized oracles is not abandoned.

However, don’t think Chainlink can solve absolutely all problems. Although projects such as Synthetix, Aave, and others already use Chainlink technology, new risks also continue to emerge. If too many platforms use the same oracle, they will all experience outages when Chainlink algorithms encounter problems.

However, the likelihood of such a scenario is low. After all, Chainlink is a decentralized oracle service that presumably has no single point of failure. In September 2020, Chainlink nodes were subjected to a “spam attack” – then attackers managed to steal about 700 ETH from the wallets of node operators. The attack was quickly stopped, but this case is a reminder that systems are not completely resistant to malicious actions.

LINK offering and issuance

The maximum offering of LINK is 1 billion tokens. In 2017, 35% of this amount was sold out during the ICO. About 300 million tokens belong to the company that founded the project.

Unlike other crypto-assets, LINK does not provide for the possibility of staking or mining, as this would increase the number of tokens in circulation.

How to store the LINK

LINK does not have its own blockchain. It exists as a token in the Ethereum blockchain. LINK tokens conform to the ERC-667 standard, which is an extension of the ERC-20 standard. In other words, you can store LINK in any supported wallet, such as Trust Wallet or MetaMask.

What is LINK used for?

Chainlink node operators can bid with prospective data buyers on LINK tokens. If the operator “wins” the bid, it will have to provide the information to the smart contract that executes the request. All payments for node operators are made in LINK tokens.

This approach motivates operators to continue to accumulate tokens, since owning more opens access to larger and larger contracts. If a node operator breaks the rules, it will lose its LINK tokens.

Who are the LINK Marines?

It is not uncommon for members of crypto-project communities to be given different pseudonyms. Chainlink with its “marines” was one of the first and most successful examples of this phenomenon.

Creating a community of this type has also become an effective marketing tactic in the cryptocurrency space. Loyal fans are able to attract a lot of attention to the project in social networks and increase user engagement, which can subsequently have a positive effect on other indicators as well.

Closing Thoughts

Chainlink technology has become one of the most important aspects of DeFi and the entire crypto ecosystem. While there are still some risks to DeFi in the Ethereum network, reliable external data sources are an important foundation for a healthy ecosystem.